The crypto market has been hit by a sharp and unexpected dip in November 2025. After a euphoric rally that sent Bitcoin (BTC) to more than $125,000 in October, prices have fallen by more than 20%, dragging many altcoins down with it too. This has happened at a time when investors were expecting BTC to reach $150,000. However, the market has just decided to move opposite to what the crowd expected. Yet for investors who understand halving cycles, this slump could be a reset. This dip could be offering clarity, opportunity, and a stronger foundation for the next bull run.

In this article we examine why this dip might be healthy, what to monitor next, and how you can position yourself wisely.

Why BTC and Crypto Market is Down?

There are three major reasons behind this ongoing down trend in BTC and other crypto prices.

• Massive outflows from ETFs and funds

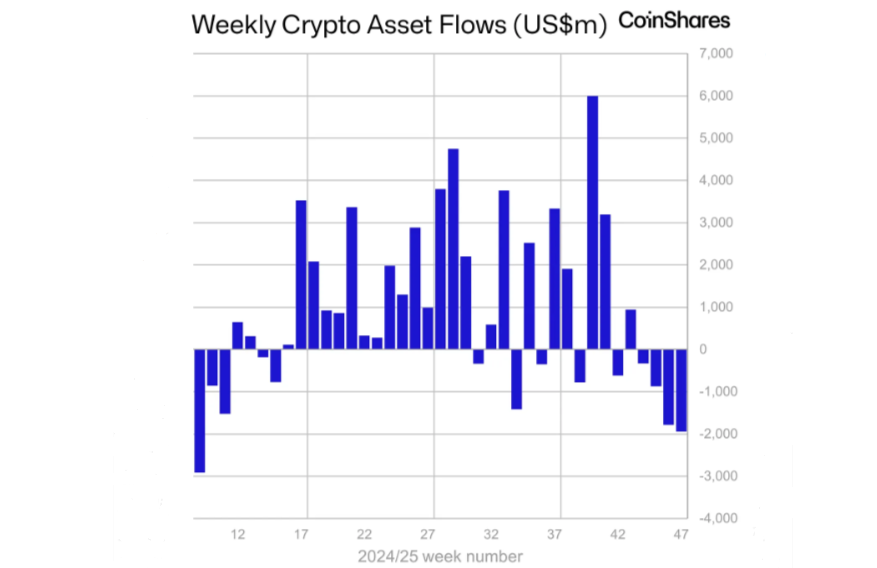

The sell-off in November has been fueled by institutional withdrawals. Funds that had earlier bet on crypto’s upside, including spot-Bitcoin ETFs, saw large outflows. It is because some investors sought to lock in gains or cut exposure amid macroeconomic uncertainty. To be precise, digital assets have witnessed $5.11 billion in outflows in the last three weeks, as per weekly reports by CoinShares.

• Macro stress and risk-off sentiment

Broader financial market turbulence and risk aversion among investors spilled over into crypto and other assets perceived as “risky.” This has happened due to uncertainty in the US economy.

• Profit-taking after overheated advance

The October highs had drawn in a wave of speculative buying. Once prices peaked, many participants took profits adding downward pressure. The steep rise followed by a sharp correction is typical of asset cycles and may not reflect a structural problem.

Why This Could Be a Healthy Reset for the Crypto Market?

This market reset, although it is not over yet, can be healthy for the market from 3 perspectives.

• Clearing excess speculation and paving way for fundamentals

The recent volatility is forcing out overly speculative capital as the market always punishes weak hands. What remains is more likely to be aligned with long-term conviction, project fundamentals, and real use cases. This cleansing could lay a stronger foundation for sustainable growth.

• Attractive entry points for long-term investors

For investors focused on multi-year horizons, corrections offer a chance to accumulate quality assets at a discount. Particularly with many projects and networks still pushing major upgrades, dips like this sometimes precede the next leg of growth. The targets that were anticipated this cycle have now more possibility of hitting next cycle. The long term Bitcoin price prediction 2040 is still not ruled out.

• Time to reassess risk, tokenomics, and roadmaps

While prices swung up and down, many investors didn’t take time to evaluate actual project health in factors like staking yields, network activity, development updates, tokenomics, and macro resilience. A reset creates breathing space for due diligence and smarter positioning. This is the time you abandon weak projects.

What to Watch in the Coming Months

ETF flows and institutional sentiment. If withdrawals slow and inflows resume, especially from long-term investors, this will signal the bottom is in. This could be the time to reaccumulate for those who have stablecoins in hand.

Major network upgrades and ecosystem developments. Some Layer-1 and Layer-2 blockchains are rolling out upgrades and new tooling. These could reignite demand. For example, the Ethereum mainnet upgrade Fusaka is scheduled for 3rd of December 2025. If you don’t understand complex blockchahin ideas, you can read beginner-friendly blockchain and crypto education articles before making next investment.

Macroeconomic and macro-finance conditions. Global liquidity, interest rates, and risk-asset sentiment will continue to impact crypto’s path. The end of quantitative tightening by the US FED will also be helpful for risk assets.

Regulatory clarity (or lack thereof). As regulations evolve globally, assets with strong compliance and institutional readiness may outperform. Regulated environment attracts more capital as only less than 10% of the world’s population has invested in crypto so far.

How CrypBlock Readers Can Approach This Period

Focus on fundamentals, not noise. Use this time to read project whitepapers, examine on-chain metrics, and follow development. Totally avoid hype and don’t invest in FOMO.

Diversify, and avoid over-concentrating on a single token. Spread risk across established cryptos, promising layer-1s, and maybe a few high-potential altcoins. These coins may be $LINK or $ETH but do your own research as this article is not a financial advice.

Adopt a long-term mindset. Don’t chase short-term spikes. If you believe in the long-term value of blockchain and decentralization, now might be a good opportunity to accumulate.

Stay informed about upcoming upgrades and ecosystem move via credible sources like CrypBlock where experienced authors share well researched content. Join project channels, follow developer roadmaps as many big moves happen during “quiet” market phases.

Conclusion

Market downturns are never fun. But history shows they often precede the next wave of innovation and growth. The November 2025 crypto dip may not just be a correction, it could be a necessary realignment, bringing new clarity and preparing the ground for long-term strength. For disciplined, long-term investors who keep their focus on fundamentals and blockchain value beyond price action, this could be one of the better times to build position.

FAQs

Why did Bitcoin and crypto crash in November 2025?

The November 2025 dip was driven by ETF outflows, macroeconomic uncertainty, and profit-taking after Bitcoin’s rally to $125,000.

Is the November 2025 crypto dip a healthy market reset?

Yes. The dip is flushing out weak speculation, creating better long-term entry points, and shifting focus back to fundamentals and real project utility.

How much money flowed out of crypto funds in November 2025?

Digital asset funds saw over $5.11 billion in outflows during the first three weeks leading up to the November correction.